The Problems with Plastics: Slovenia risks EU fines while the new EPR regulation is under constitutional review (Part 2)

An opaque packaging waste management system in Slovenia does little to incentivise producers toward sustainable products

Original article in Slovene: Zakon v ustavni presoji, medtem tvegamo kazen Evropske komisije

Plastic production keeps increasing each year in every part of the world. Despite its progressive legislation, the EU is no exception.

While EU recycling rates may be on the rise, the amount of generated plastic (and consequently, plastic waste) is rising faster. In 2018, member states recycled nearly two million tonnes of plastic packaging more than in 2010, however, with the steep increase of generated waste, an extra 650,000 tonnes were left unrecycled. As a result, despite rising recycling rates, each year more plastic waste gets incinerated, landfilled or leaked into the environment.

In 2018, as part of the UN 2030 Agenda for Sustainable Development, the EU adopted a new strategy to tackle its plastics problem – A European Strategy for Plastics in the Circular Economy. The overarching goal was to ensure all plastic packaging placed on the EU market could be reused or recycled by 2030.

In line with the strategy, a set of directive changes followed. The amendments to the Directive on waste were adopted in May of 2018, setting minimal requirements for Extended Producer Responsibility (EPR) schemes for the first time.

Under EPR schemes, producers – this piece will focus mainly on packaging producers – are responsible for their products until the very end (when products become waste). In Slovenia, packaging producers can fulfil their EPR obligation on their own or (more commonly) via a producer responsibility organisation (PRO). Different producers may pay into one PRO which is then responsible for managing packaging waste on behalf of those producers.

Our findings show that the Slovenian packaging waste EPR scheme has many systemic problems. In the first two parts of our investigation, we delved into the confusing quota system used to determine the shares of waste that each PRO is to collect from public utility companies. Because several packaging waste PROs operate in Slovenia, their share of waste is to correspond to the market share of each PRO’s producers. This share is set each year by the environment ministry through quotas, which, due to an insufficient legal basis, have been the subject of litigation for over a decade.

While the ministry and PROs battled in court over the quotas, uncollected packaging waste kept accumulating at public utility providers’ sites. In 2018 and 2020, the government ended up investing 16.5 million euros of taxpayer money in intervention measures to collect the accumulated waste. This had a toll on the environment as well as the taxpayers. With the packaging waste stored outdoors for months at a time and gradually losing recycling potential, over 80% ended up in incinerators.

Quota complications, however, are not the only systemic problem relating to Slovenian packaging waste EPR schemes. In the third and fourth part of our investigation, we focus on cost distribution in EPR schemes, the connections between some PROs and their subcontractors, and the potential breach of the EU Directive on waste. We find the packaging waste management system in Slovenia to be opaque and lacking in mechanisms that would incentivise producers to choose more sustainable packaging.

The EPR system in Slovenia may be facing a complete makeover as the third Environmental Protection Act (ZVO-2, ‘Zakon o varstvu okolja’), adopted in March 2022, introduces several reforms in the field. Among other changes, the new regulation mandates that each waste stream is to be managed by a single not-for-profit PRO, owned by the producers.

The majority of the country’s waste packaging PROs have filed for a constitutional review of the EPR reform introduced by the new Environmental Protection Act. The court decided to temporarily suspend the implementation of the disputed articles. It has yet to decide whether the reform is constitutional – only then will the suspension be lifted or rendered permanent.

As the entire sector is waiting for the final verdict, deadlines pass. EU member states were required to implement the minimal requirements for EPRs as mandated by the Directive on waste by January 2023. Slovenia included them in the new Environmental Protection Act, but their implementation is still temporarily suspended and their future unknown. A spokesperson for the ministry told us the government is unable to push further regulation until the Constitutional Court rules on the disputed articles.

The future of EPR schemes in Slovenia remains unknown. However, minimal requirements set in the EU Directive on waste require member states to ensure the equal treatment of producers; to make public the information on the financial contributions paid by producers per unit of product placed on the market; to appoint, in states where multiple PROs implement EPR, at least one body independent of private interests to oversee the implementation of EPR obligations; and to ensure that the financial contributions paid by producers cover, among others, the costs of separate collection of waste and its subsequent transport and treatment. These are just some of the minimal requirements member states were required to meet by January 2023.

Some waste is profitable, some generates costs

Different types of packaging waste differ in value.

As noted by the Slovenian Chamber of Public Utilities (‘Zbornica komunalnega gospodarstva’): “Paper and cardboard, glass, certain metals, as well as PET bottles and transparent film all have a positive market value as they are mostly sold to recycling companies. Other packaging materials are usually incinerated and therefore present costs.”

Packaging waste is either generated in households (municipal packaging waste) or in industry, retail, and elsewhere (non-municipal packaging waste).

In the current EPR scheme, non-municipal waste is a private matter between PROs and companies/producers, while municipal packaging waste collection is regulated.

Public service providers who collect packaging waste from households are obligated to hand all the collected waste over to PROs free of charge regardless of the possible value of the materials, while the inspectorate is responsible for monitoring this in practice. Additionally, each PRO is required to collect packaging from every single public service provider in the country.

In theory, they are obliged to collect an amount corresponding to their producers’ market share, represented in government quotas. The quotas are currently set quarterly and separately for four packaging materials: paper and cardboard, glass, wood and mixed packaging (including plastics, metals, composites, and other materials). The quotas, however, have been the subject of legal disputes for years.

Non-municipal packaging waste collection is a matter of contractual arrangements between PROs and producers. It is mostly collected directly by PROs or their subcontractors from sites where it is generated. Non-municipal waste is generally much cleaner and therefore preferable. Municipal packaging waste, on the other hand, is usually a mix of different packaging materials, which means additional sorting; and contaminated with decaying food leftovers, which means additional cleaning.

Households still bear the bulk of the municipal waste management costs

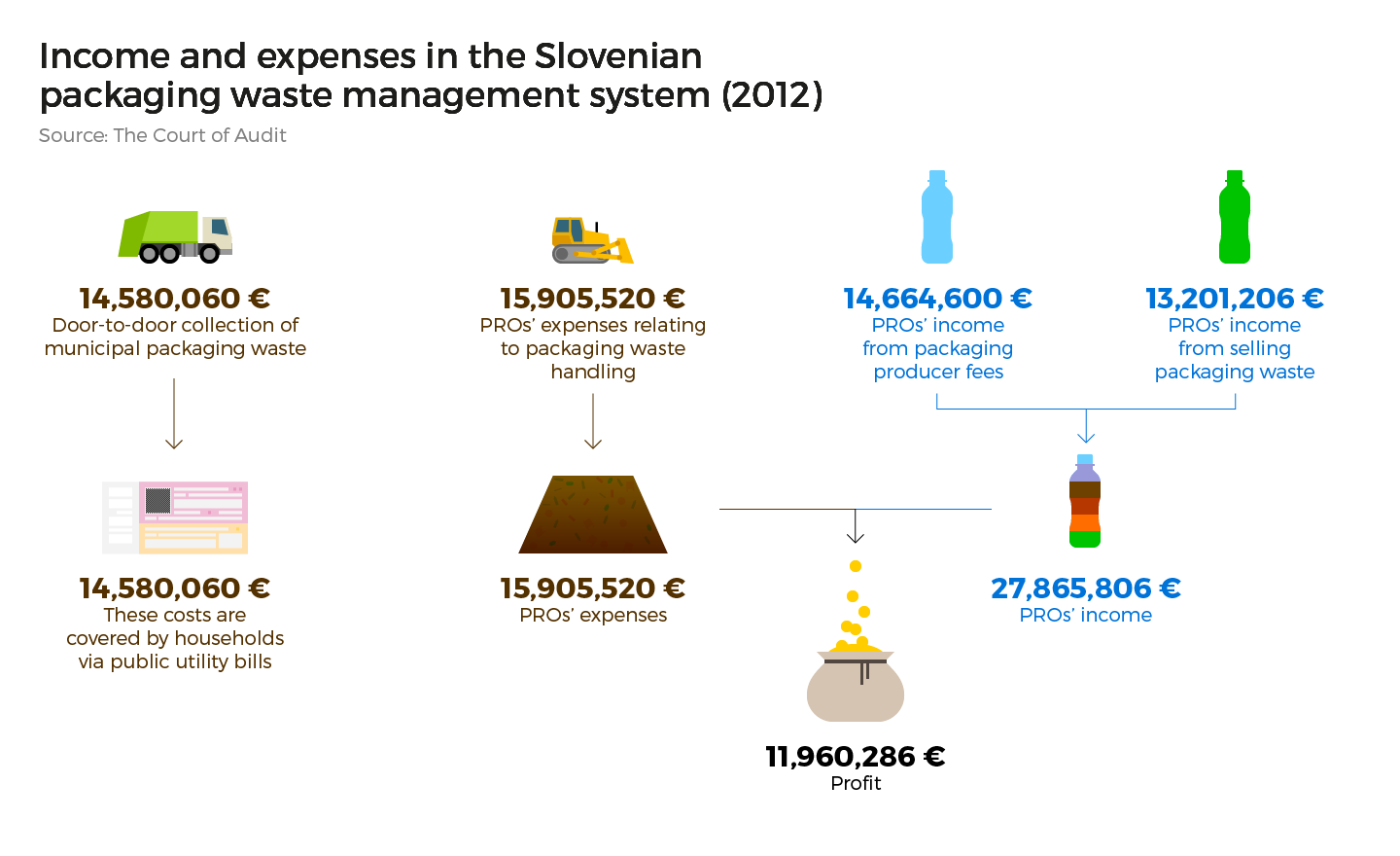

As the Court of Audit has repeatedly pointed out, the packaging waste EPR scheme in Slovenia lacks transparency, especially in terms of costs.

Many companies are at play in the system: about 9,400 producer companies pay packaging fees to one of the 6 PROs, who then handle the waste management via numerous subcontractors.

The PROs collect non-municipal packaging waste directly from the producers, whereas municipal packaging waste is collected by 71 public service providers. The PROs collect waste corresponding to their producers’ market share from each of the public service providers – at least in theory. As we discovered in the first and second part of this series, in practice, the shares determined by government quotas have been disputed in court and tonnes of waste remained uncollected.

In line with regulations passed in 2006, Slovenian public service providers (or rather, households via utility bills) are responsible for covering the costs of door-to-door municipal packaging waste collection. The PROs then have to cover the costs of waste handling from the moment they collect it from the public service providers.

In a 2015 report, the Court of Audit pointed out that Slovenia is the only EU member state where all costs related to municipal packaging waste collection in EPR schemes are covered by households rather than co-financed or fully covered by PROs.

The country’s new Environmental Protection Act (ZVO-2) which passed in March 2022 includes articles mandating PROs to cover all waste collection and handling costs, but they have not been implemented yet due to the constitutional review.

For the time being, households still bear the majority of the costs covering municipal packaging waste management – 65-70%, according to an analysis by the country’s Institute of Public Services (‘Inštitut za javne službe’). These costs cover the infrastructure and workforce needed to collect packaging waste from designated bins in the Slovenian door-to-door system. The rest of the costs, which include collection from public service providers, any further sorting, and final disposal or reuse, are covered by PROs (or rather, by producers via PROs).

In line with amendments made to the Directive on waste in 2018, transferring waste collection costs to PROs is also one of the minimal requirements for EPR schemes in member states. The directive requires member states to guarantee that PROs start covering the majority of the costs by January 2023, which has not happened in Slovenia.

The ministry confirmed it is unable to proceed with regulation changes because the constitutional review of the Environmental Protection Act is delaying the implementation of EPR reforms. A spokesperson for the ministry added that the ministry has urged the Constitutional Court to issue a verdict as soon as possible as Slovenia is now risking European Commission penalties.

Lack of transparency and no incentive for sustainable packaging

As the Court of Audit has repeatedly pointed out, the Slovenian packaging waste EPR scheme is opaque and inefficient due to a lack of oversight over costs and expenses.

PROs have been obligated to report on costs and expenses related to packaging waste management since 2006, but as the regulation was not precise enough, each PRO reported data which was organised in line with their own internal systems and not necessarily comparable to the data of other PROs. The court stated that it was often not clear from the PROs’ self-reporting how much of their revenue came from packaging fees paid by producers and how much came from selling packaging waste materials.

In a 2015 audit report, the court estimated the incomes and expenses in the packaging waste management system. Using data from 2012, it estimated the PROs packaging waste handling costs at 15,9 million euros, and their incomes from producers’ fees plus selling waste at 27,9 million euros.

The Court of Audit found that leaving it to the PROs to set unregulated prices for producers’fees, combinated with a lack of obligation to report costs, presented a departure from the ‘producer pays’ principle, upon which EPR schemes are built.

The 2015 report stated that a “lack of regulation over PRO finances lead to PROs charging higher packaging fees than any costs they had with handling packaging waste”. As producers financed their extra costs with higher product prices, consumers were ultimately funding either PRO companies’ other operations or in some not-for-profit cases, extra income that would return to producers.

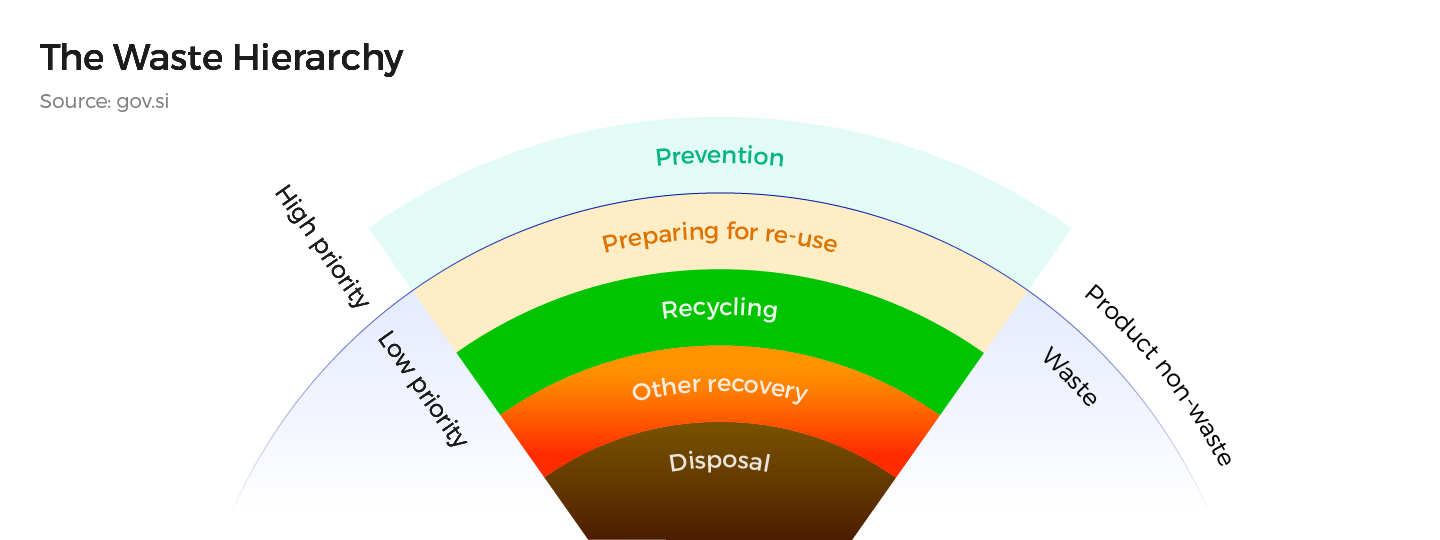

The prices for packaging producers’ fees are normally negotiated between producers and PROs and in Slovenia, there is no supervising body (or ‘clearinghouse’) overseeing them. This means that there is also no supervision over the connection between fees and product sustainability (‘eco-modulation’).

New minimal standards for EPRs set in the Directive on waste require countries to take measures to ensure financial contributions paid by producers are modulated by “taking into account their durability, reparability, re-usability and recyclability and the presence of hazardous substances”. The Commission is therefore trying to encourage member states to make producer fees in EPR schemes higher for less sustainable packaging products.

Eco-modulation is also meant to act as a financial incentive for producers to invest in developing more sustainable packaging in order to avoid higher EPR fees. In this way, packaging EPR schemes would, in theory, contribute not only to waste management goals, but also have an impact on waste generation itself as they would change what kind of packaging is placed on the market – a priority according to the waste hierarchy.

The ministry, in responding to the 2015 Court of Audit report, explained that “PROs are autonomous in setting fees and costs and the fact that they compete on the same market means they achieve optimal prices as well as fulfil environmental goals by optimising their business models.”

A few years later, a ministry-funded analysis of the packaging EPR scheme by the Institute for Public Services offers a different explanation: “Despite the competition between these organisations, in practice, the organisations did not reduce costs through innovation, but through service downgrading and ‘cherry picking'”. The term cherry-picking refers to a selective collection of packaging waste according to its market value.

PROs and their subcontractors

PROs normally manage waste handling via subcontractors who provide transport, waste collection, sorting, and processing.

In Slovenia, two PROs, Dinos and Surovina, not only manage the system, but also provide the related services. A third PRO, Recikel, also has ties to a subcontractor in the system – Salomon. All three PROs are either merged with or vertically connected to companies operating in the system they manage.

This may mean that a PRO provides services (e.g. collection of waste) to an EPR producer with whom it has a contract, while also acting as a subcontractor offering the same service to a competing PRO.

As data we obtained from the Slovenian Environment Agency shows, the six Slovenian PROs worked with 745 domestic and 213 foreign subcontractors between July 2021 and June 2022. Among domestic companies, six of them were hired by all six PROs. Both Dinos and Surovina (PROs themselves) were among them.

Effectively, this means that both Dinos and Surovina provided waste handling services to ‘themselves’ as well as all of the PROs they are competing with. This is legal under current regulations, but the new Environmental Protection Act (ZVO-2), currently under constitutional review, would prohibit vertical links between PROs and companies operating in the system PROs manage.

Suspicions of a possible waste management cartel

In late 2019, the Slovenian Competition Protection Agency (‘Javna agencija Republike Slovenije za varstvo konkurence’) issued a decision accusing Surovina, Dinos, Recikel and Salomon (a contractor linked to Recikel) of forming a cartel with the object of driving their competitor Interseroh (now named Interzero) out of the PRO market.

Surovina and Dinos act as both PROs and subcontractors in the system while Recikel is linked to the subcontractor Salomon. In the decision, the agency noted that the four companies had agreed to stop providing services as subcontractors to their PRO (system management-level) competitor Interseroh.

One of the accused PROs filed a leniency application, pleaded guilty and later cooperated with the agency by disclosing its participation and providing the agency with additional evidence.

The other two PROs filed for judicial review before the Administrative Court. The decisions are not yet final and legally binding.

We contacted all those involved for comment. Surovina denies the allegations and stresses there was no such cartel. It adds that the decision has already been annulled by the Administrative Court and that further court proceedings will confirm the Administrative Court’s ruling.

Recikel is confident that the court proceedings will ultimately show that the alleged infringements never happened.

Dinos will not comment until court proceedings end. Interzero also said it cannot comment on the details until proceedings end and added that Slovenia needs some kind of supervisory body overseeing this sector if it is to improve transparency.

The agency confirmed that one of the decisions is pending before the Administrative Court, while another has been annulled, however, the annulment itself is now pending further reviews at higher courts.

In the next and final part of this investigation, find out how new regulations, currently under constitutional review, would completely transform EPR schemes in Slovenia.

How the new Environmental Protection Act would transform EPR schemes in Slovenia

The new Environmental Protection Act (ZVO-2), adopted in March 2022, stipulates that each waste stream should be managed by a single non-profit organisation, owned by the producers and operating under a supervisory body.

It also prohibits any capital or family links between PROs and subcontractors, and it mandates the so-called eco-modulation of prices for EPR producer fees, which translates to packaging fees being set according to the sustainability of the packaging that producers place on the market.

SYSTEMIC REFORM OF THE EPR SCHEME UNDER ZVO-2:

- 1 waste stream = 1 single not-for-profit PRO (producer responsibility organisation)

- the organisation must be owned solely by producers; the ownership share of one producer must not exceed 25%; together, the owners must cover at least 10% of the market share for the EPR product in question

- all vertical links (capital or family) between organisation managing the system (PROs) and companies operating in the system (subcontractors) are prohibited

- the organisation is only allowed to manage the system, selecting subcontractors through public tenders

- the organisation is overseen by a supervisory body (2 representatives of producers or owners, 2 representatives of associated producers, 1 representative of the ministry)

- when setting prices for producer fees, the organisation must take into account the actual costs and revenues from the re-use of products and eco-modulate prices as far as possible

- producers also bear the costs of municipal waste collection

Any profit a PRO might make has to be either returned to producers who paid into the EPR scheme or used for future waste handling operations (and discounting producer fees at that time) according to the new reform.

A single not-for-profit PRO per scheme is not a EU novelty; other member states, such as the Czech Republic, France, Spain, Belgium and the Netherlands among others, conduct EPR schemes this way.

The PROs Interzero, Dinos, Surovina, and Recikel filed for a constitutional review of these reforms and consequently their implementation is temporarily suspended awaiting the ruling.

The PROs argued that the new reform, if implemented, would violate their constitutional rights as they would lose their PRO status immediately. This kind of government intervention, they argue, would only be justified in cases of the overriding reason of public interest, which they believe the government will not be able to prove.

The PROs further argued that the change of PRO activity from commercial to not-for-profit constitutes the highest possible degree of market restriction. They believe the reform establishes a monopolistic organisation and breaches the right to free economic initiative.

The government, in reply, argued that EPR schemes were never meant to be the grounds for profitable commercial activity, but rather a system created for the achievement of environmental objectives and recycling targets. The government denies any interference with economic incentives as they do not view EPR schemes as a legitimate free market.

They continue with the argument that in the current system, PROs act mainly to pursue commercial interest instead of acting to fulfil producers’ obligations in reaching environmental targets. They argue it is in the public interest to increase the efficiency of EPR schemes. The government also stated that were the contested articles to be suspended, Slovenia would risk further waste accumulation and state interventions with taxpayer money.

In their official response within the legal proceedings in May 2022, government representatives also warned that should the reforms be suspended, “the obligation to establish the minimum requirements of EPR schemes in accordance with the EU directive would remain unfulfilled and proceedings against Slovenia for breach of EU law would continue.” However, in response to our inquiries in March 2023, the ministry said that such proceedings are not ongoing as the European Commission had not yet initiated them.

In May 2022, the Constitutional Court decided to suspend the implementation of most of the contested articles pending a final decision, thus delaying a potential EPR reform until it has ruled on the constitutionality of the renewed system foreseen by ZVO-2.

The entire sector awaits the Constitutional Court’s decision

Currently, the future of Slovenian EPR schemes remains unclear.

Tanja Bolte, acting Director of the Environment Directorate at the Ministry of the Environment, Climate and Energy, told us the ministry is awaiting the ruling and hoping the court finds the reforms constitutional. She also underlined the ministry’s view that a single non-profit organisation managing all packaging in Slovenia would be more efficient and economical.

The claim about efficiency is partly drawn from the findings of an analysis published in September 2021, which the ministry commissioned from the Institute for Public Services and which we obtained via an FOI request.

The PRO Interzero commissioned another analysis by economists Aljoša Feldin and Sašo Polanec, published in August 2022. Their study highlights the correlation between the intensity of competition and the levels of investment and innovation. The authors argue that the new reforms would actually decrease efficiency and suggest less government regulation – they also argue against the one PRO per one waste stream limit.

Another study, published in 2018 by the Czech CETA – Centre for Economic and Market Analyses, stresses, on the other hand, that the neoclassical economic theory does not apply to EPR waste management, as it is not a classical market with a supply-demand correlation, but rather an artificially created market based on regulations with clear political objectives.

In this artificially created market, the authors argue, competition doesn’t necessarily lead to efficiency since PROs get their income from producers upfront. This income is earmarked for the management of the waste that is yet to be generated from producers’ packaging. Producers have to pay the fees because of legal requirements intended to ensure achieving environmental objectives.

The quality of the service provided therefore has no impact on the financial inflow (in the form of packaging fees) which is made in advance. The CETA study concludes that more organisations in an EPR scheme doesn’t necessarily mean improved performance, but it is rather the other way around in many cases. The authors also conclude that single-organisation systems achieve higher separation and recycling rates and that the not-for-profit status of the organisation is a prerequisite for preventing abuse and ensuring the functionality of the system.

The fact that single-organisation systems are cheaper and more efficient is also highlighted in an analysis by the authors from Bocconi University, based on a comparative analysis between different systems.

The representatives of environmental NGOs we spoke to joined the ministry in hoping that the Constitutional Court will allow the implementation of the EPR reform. “The original intention was never to make profit from garbage. The EU waste policy directs us to regulate waste management in line with the public interest and to achieve environmental objectives, not economic ones. In our country, this system has strayed away from what the EU dictates in terms of priorities in waste management – the priority is recycling, reuse – not cheaper disposal,” said environmental lawyer Aljoša Petek from Slovenia’s Legal Centre for the Protection of Human Rights and the Environment (PIC, ‘Pravni center za varstvo človekovih pravic in okolja’).

The Slovenian NGO Ecologists Without Borders (EBM, ‘Ekologi brez meja’) also supports the new EPR reform presented in ZVO-2, Jaka Kranjc told us. “The system has been congested for more than 10 years. We have new commitments to the EU all the time and this communication between organisations and the producers they represent does not work in the current system.” Kranjc stressed the importance of establishing the eco-modulation of prices and thus transforming the system so that producers are forced to put more sustainable products on the market.

The country’s Chamber of Municipal Economy (‘Zbornica komunalnega gospodarstva’) supports the EPR reform set in ZVO-2. It added that it has been pointing out the inadequacies of Slovenian EPR schemes since 2008 and that the new legislation foresees the right solutions which are also in line with positive practices in other EU countries.

The PRO Slopak also supports the EPR reform as foreseen in ZVO-2. PROs Interzero, Dinos, Recikel, and Surovina do not support the changes and have filed for a constitutional review.

PRO Interzero sees the new reform as a path to monopoly. “It is a path to monopoly, to price cartelisation, to the destruction of knowledge in the field of sustainable services, and that is why we and a number of producers have submitted a request for a review of the constitutionality of the law. We were also disappointed to see no mention of an independent agency that would oversee this area in ZVO-2. The law is therefore good in some parts and disastrous in others,” they wrote.

Recikel wrote that it does not support the one-organisation-for-one-waste-stream system envisaged in ZVO-2. It added that it would support a one-organisation system “if it was foreseen that this organisation would actually ensure appropriate waste management standards, a comprehensive control of the system, the appropriate sanctioning of offenders and the selection of packaging service providers via the producers or retailers who would ultimately pay for these services and who would be interested in the most appropriate selection”.

Dinos responded that it does not support the proposed PRO arrangements. Surovina wrote that they considered the change inappropriate. The sixth PRO, Embakom, did not wish to comment.

The ministry hopes that the EPR reform will be implemented. “The current EPR schemes are distorted due to all the changes. The producers put a product on the market and don’t care where it ends up. We expect this to change when producers are actually owners of PROs. We want PROs to be not-for-profit and we want only one PRO per waste stream. These reforms will make the system more efficient,” Bolte told us.

If the court suspends the implementation of the disputed reforms, the ministry plans to introduce different reforms that would still completely transform the way Slovenia does EPR. They would still introduce most of the requirements outlined in ZVO-2 except for the one-PRO-per-waste-stream rule. They would still require not-for-profit PROs, producer ownership of PROs, and eco-modulation of producers’ fees, and they would prohibit vertical links between PROs and subcontractors. In cases of several PROs managing the same waste stream, the ministry’s reform would require a supervisory body or clearing house to supervise and coordinate prices and operations.

We asked the packaging waste PROs how they plan to proceed if the ZVO-2 reforms are implemented. Dinos replied that it would hold off any decisions until the ruling. Surovina would continue providing waste management services even if it loses itsPRO status. Recikel wishes to continue its operations, but not as a “monopoly organisation”. If the reforms pass, it will continue its operations under the management of a new organisation or agency. Interzero stated that it would respect the court’s decision and stop its operations as it would not be able to fulfil the PRO requirements in that case. Slopak, on the other hand, plans to operate as a packaging waste PRO should the reform pass.

It is not known when the Constitutional Court will make its ruling. In the meantime, it is also still unclear whether the current legal regime, combined with the currently valid PRO permits, will be sufficient to prevent the Administrative Court from once again overturning the inspectorate’s decisions forcing PROs to transport uncollected piles of packaging (more on this problem in previous parts of this investigation: Introduction, Part 1).

The Problem with Plastics investigation was created within the framework of the European Data Journalism Network (EDJNet), an international project, which is co-financed by the European Commission between April 2021 and March 2023.

Nastanek tega članka ste omogočili bralci z donacijami. Podpri Pod črto

Deli zgodbo 0 komentarjev

0 komentarjev